In this article, you will learn how to obtain USDX on the Kava platform using Kava Mint, Kava Lend, and Kava Swap, plus how to get it outside of the Kava ecosystem.

Kava’s native stablecoin is USDX. Kava governance decisions and market flow determine the stability of $USDX, which is not directly linked to a value of $1.

$USDX’s primary utility lies in its Kava-related use cases. Since $USDX is a consistent store of value, the stablecoin also provides opportunities to long or short assets and lock in the value of assets that fluctuate in value. In addition, $USDX receives extra incentives on Kava Lend – the primary partner for exchanging coins or adding liquidity on Kava Swap – as well as being tradable on the Ascendex Exchange.

How to Obtain USDX

A few methods for obtaining $USDX exist both within and outside the Kava Platform. Each method has its pros and cons, which I’ll dive into below.

- The first method is to borrow $USDX by supplying other assets as collateral on either Kava Mint or Kava Lend, then borrow $USDX against that collateral. This approach is great if you don’t want to sell your crypto but still want to take advantage of DeFi yields.

- The second method is to trade other tokens for $USDX on Kava Swap or another DEX. You don’t retain ownership of the original asset, but this can be the right approach when timed correctly.

- The third method is to buy on a centralized exchange (CEX). To do this, you must exchange fiat (e.g., USD, JPY) for $USDX and add to the value of your crypto portfolio.

Borrowing USDX

Like any loan, you can borrow a certain amount against your collateral and a set interest rate at which your borrow amount accumulates. On Kava, interest accumulates on the borrowed amount of each block with no repayment timeframe. The borrowed amount of the loan is determined by the Loan to Value Ratio (LTV).* LTV determines the amount you can borrow based on your collateral value, so if you provide $100 of collateral with an LTV of 99%, you can borrow $99.

*Minimum Collateral Ratio is another common term to describe borrowing limits, though Kava primarily uses LTV to describe borrowing limits.

The risk: when borrowing assets backed by crypto, as the value of that crypto increases or decrease the amount you can borrow can increase or decrease accordingly. Alternatively, as the value of what you borrow increases or decreases the amount of collateral needed for the loan increases and decreases according. You need to maintain a specific LTV ratio of value borrowed vs collateral value and when that ratio reaches its threshold, your position can be liquidated. This is also referred to as the borrow limit ratio. When liquidated, your position will be closed and collateral assets will be returned, but the value borrowed plus a liquidation penalty will be removed.

The reward: borrowing maximizes your ability to earn by leveraging your assets in various DeFi strategies, without having to sell. This method is particularly effective when borrowing stablecoins since the borrow value remains consistent. Any earnings you gain with your borrowed assets remain yours since you only need to repay the original value of the loan.

Pros and Cons Borrowing USDX on Kava Mint

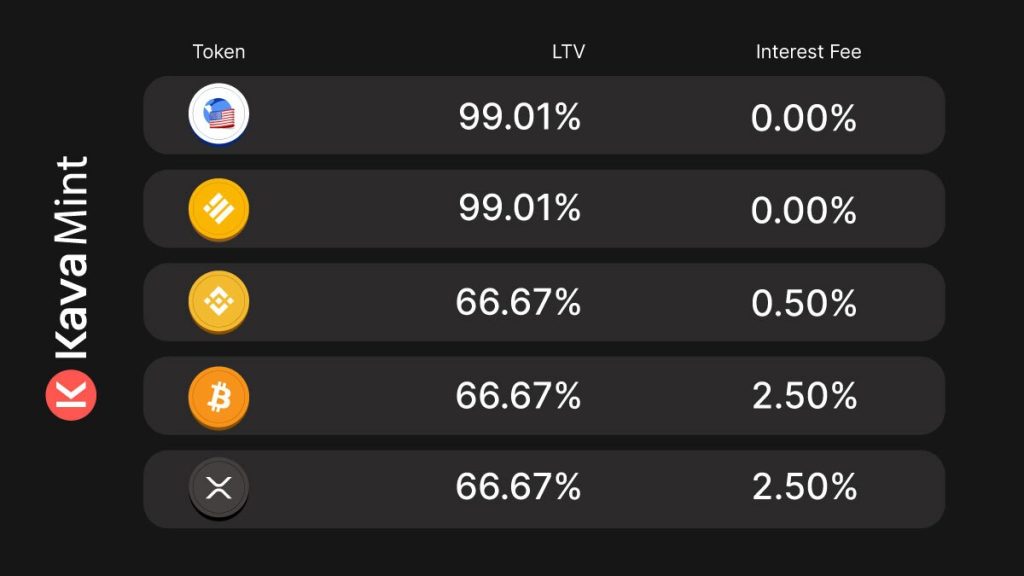

Pros: The primary benefit of Kava Mint is that you can borrow more against the collateral you provide compared to other platforms. LTV ranges between 66.7% — 99%, which is near the highest in the industry. Interest rates are fixed, ranging between 0% — 2.5% for blue-chip assets like $BTC, $BNB, $BUSD, etc. Regardless of the amount you borrow against your collateral, the interest rate remains the same. Nexo, for example, provides crypto-backed loans at low rates, but once you borrow more than 20% of the collateral value supplied, the interest rate jumps to 6.9%. LTV on Nexo tops out at 50%, so by comparison, you can borrow between 16.7% — 49% more against your collateral on Kava Mint. Stablecoin loans on Kava Mint are among the most competitive in the industry.

Cons: Debt positions are managed in isolation. That means that if the price of one collateral asset suddenly falls below the LTV ratio, it can put that loan at liquidation risk. Loans backed by multiple assets as collateral can be more stable since LTV isn’t influenced as much by the value of a single asset. An isolated debt position also has benefits since one asset liquidation won’t impact other loans.

Pros and Cons Borrowing USDX on Kava Lend

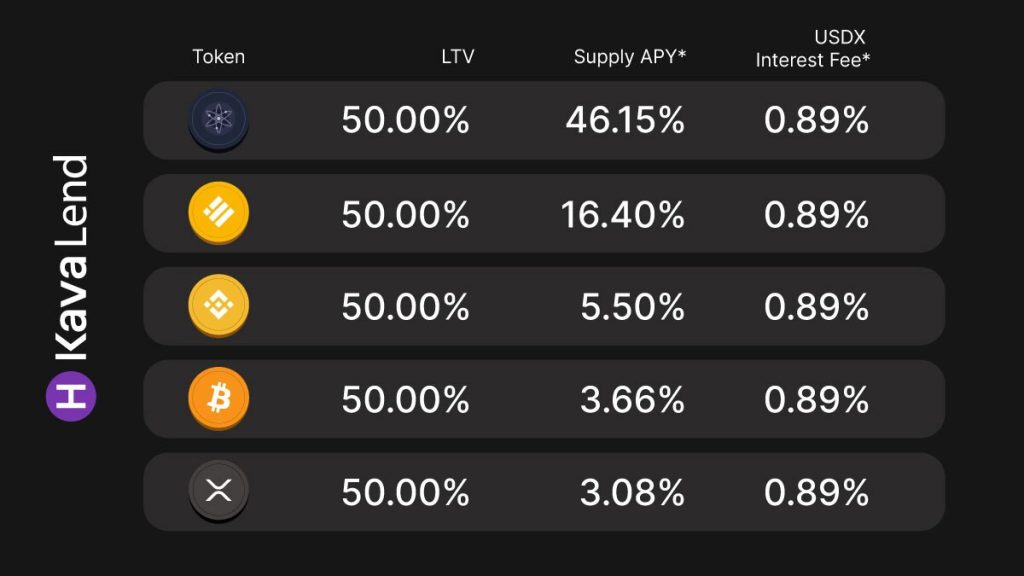

Pros: You can supply multiple coins as collateral for a single $USDX loan. The interest rate for $USDX on Kava Lend is variable based on total supply vs. total borrow but is generally lower than 1%, regardless of collateral. If you supply $BTC, $ATOM, and $BNB as collateral, one coin can drop in price while the others hold up the value of your collateral. You’ll also earn both supply APY and rewards APY for simply supplying collateral to money markets on Kava Lend.

Cons: LTV is 50% for all collateral assets, meaning the max amount you can borrow is 50% of the value supplied. While managing all your collateral assets in a single debt position can be beneficial, it does carry a risk if your position reaches the LTV threshold. If managed improperly, the entirety of your collateral supplied can get liquidated.

Trading for USDX on Kava Swap

Swapping your asset for $USDX is a little more straightforward. There’s no loan to manage and no interest to calculate, but you lose ownership of your original asset. So if you sell a variable asset at a lower value than when you bought it, you’re locking in those losses. Conversely, you lock in those gains if you sell after it appreciates value. The risk and the reward are that your original assets’ value changes in a way that makes you wish you would’ve held just a little bit longer. There’s also are some swap fees you’ll need to pay to the liquidity providers of the Swap Pool to complete the exchange, but there are no ongoing fees.

Buy USDX on CEX

The easiest option for many users may be to buy more $USDX on a central exchange with a credit card, debit card, or bank transfer. Currently, Ascendex is the primary central exchange to support $USDX and serves as a nice on/off ramp for crypto investors looking to spend their gains.

Via this site