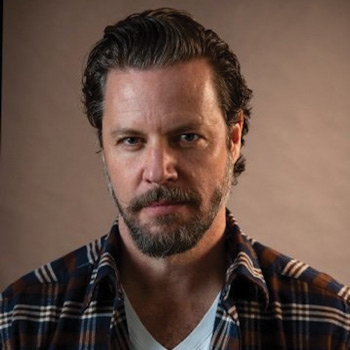

BioSig Technologies Appoints Russell Starr as Strategic Advisor to Streamex

BioSig Technologies, Inc. has announced the appointment of Russell Starr as a Strategic Advisor to Streamex Exchange Corporation, following their recent merger. With extensive experience in capital markets, business development, and transformative deal-making across both decentralized finance (DeFi) and traditional finance, Mr. Starr is expected to bring valuable insights to the company. Previously, he held a leadership role on Bay Street and has garnered a reputation for successfully navigating complex financial transactions and guiding companies through significant growth phases.

Starr’s Impact on DeFi Technologies

Most recently, Mr. Starr was the CEO of DeFi Technologies, a publicly traded firm at the forefront of decentralized finance and digital asset development. Under his leadership, the company experienced substantial growth, with share prices rising from $0.07 to $4.95 and annual revenues surpassing $200 million. He played a pivotal role in steering the company’s focus towards Web3 infrastructure and tokenized finance, further solidifying its position in the market. After stepping down as CEO, he took on the role of Head of Capital Markets, where he was instrumental in securing a Nasdaq listing for DeFi Technologies.

Strategic Vision for Real Asset Investment

Mr. Starr’s career is characterized by a commitment to long-term value creation, particularly within the natural resources and renewable energy sectors. He advocates for Canada’s growing influence in the global resource economy and recognizes the intersection of renewable energy advancements and declining fiat currencies as advantageous for real asset investments. Over the years, he has held significant leadership positions in both public and private sectors, showcasing his expertise in mergers and acquisitions, venture capital, and strategic partnerships.

CEO’s Remarks on Starr’s Appointment

Henry McPhie, CEO of BioSig and Co-Founder of Streamex, expressed enthusiasm about Mr. Starr’s addition to the advisory team, citing his extensive experience in capital markets, natural resources, and decentralized finance. McPhie noted that Starr’s visionary leadership and commitment to the value of real assets align seamlessly with the company’s mission to integrate commodities into blockchain technology.

Starr’s Perspective on Streamex’s Potential

In his remarks, Mr. Starr emphasized that Streamex is pioneering a significant transformation in the way real-world assets are accessed, valued, and traded. He highlighted that the infrastructure being developed will fully realize the potential of tokenized commodities, expressing excitement about contributing to a platform that merges deep market insights with innovative strategies.

Streamex’s Advisory Board Strengthens

Russell Starr joins an esteemed group of strategic advisors at Streamex, which includes industry leaders such as Frank Giustra, a strategic investor known for founding Wheaton Precious Metals and LionsGate Films; Sean Roosen, a prominent figure in mining and asset strategy; and Mathew August, who focuses on US capital markets. This diverse team brings a wealth of expertise, enhancing Streamex’s advisory capabilities in various sectors.

About Streamex

Streamex is a gold treasury and infrastructure firm dedicated to establishing on-chain commodity markets. The company is focused on tokenizing real-world assets (RWA) and is developing a comprehensive platform that integrates token issuance with trading infrastructure and physical gold reserves. This strategy positions Streamex to become a significant public holder of gold bullion on Nasdaq, aligning with its mission to transform global finance by bringing the vast commodities market onto the blockchain. By combining the security of physical gold with the advantages of blockchain technology, Streamex aims to create a scalable financial framework for a new digital commodities era. The firm plans to maintain substantial gold reserves, securely stored through a reputable bullion bank, and will primarily base its financial model on these vaulted assets rather than fiat currencies.

Forward-Looking Statements

This announcement includes forward-looking statements as defined under the Private Securities Litigation Reform Act of 1995. Such statements may include terms like “intends,” “may,” “will,” “plans,” “expects,” and similar expressions. These statements are not guarantees of future performance and are subject to numerous risks and uncertainties, many of which are beyond the company’s control. Actual results may differ materially from those anticipated due to factors such as the realization of benefits from the Streamex acquisition, shareholder approval, and compliance with Nasdaq’s listing criteria. Interested parties are encouraged to review the company’s filings with the Securities and Exchange Commission for additional details on risks and uncertainties that could affect future outcomes. The company does not intend to update or revise its forward-looking statements unless required by law.