This review will highlight the potential risks of using Flexible and Fixed savings accounts on Binance as well as serving as comprehensive information on one of the biggest crypto exchanges in the world. From what is the minimum deposit to how much the withdrawal fees are.

The Binance platform has facilitated trades worth trillions of pounds for its 100 million-plus members worldwide during the first half of 2021. You can access hundreds of cryptocurrencies through the Binance app and website where you can buy, sell, and trade cryptocurrency.

SEPA has recently been implemented, which makes deposits easy and fees-free. Although, recently it has been suspended. Fees are capped at 0.1 percent, which makes them quite competitive in the market (there are ways to reduce them). Binance has access to approximately 500 cryptocurrencies. Nonetheless, because of Binance’s platform’s myriad of possibilities as well as its restrictions, US residents can be intimidated by it.

Binance is a cryptocurrency exchange:

On Binance’s cryptocurrency exchange, you can purchase and sell hundreds of digital currencies. Besides allowing users to use credit/debit cards, cryptocurrencies can also be purchased via bank account transfers. With only four years in business, Binance is the biggest digital currency exchange in the world. A total of 100 million active users used the site in May 2021, which involved 2.4 trillion dollars in trading. Besides its main exchange and brokerage service, Binance offers a number of other essential functions.

You can earn interest on your digital currency assets through the cryptocurrency savings account included in the package. Binance also offers bitcoin loans in addition to digital asset debit cards. In addition to offering the Trust Wallet app, Binance is also the company behind the Trust Wallet iOS and Android app.

Binance Assets and Markets Supported:

Hundreds of cryptocurrency exchanges function on Binance. Tokens with large and small capitalizations are included. Additionally, to Bitcoin derivatives, Binance offers futures contracts and options on the cryptocurrency. As of January 20, 2021, the FCA will not allow UK retail clients to obtain these complicated financial instruments.

Buy cryptocurrency instantly:

Buying cryptocurrency is easy through Binance, and even easier when you do it right from your home. Visa or MasterCard are both accepted for use as a credit or debit card. Before you can use the Instant Buy option, you will need to submit your passport or driver’s license, as well as photo ID proof via webcam or mobile device. Typically, this process takes less than five minutes from start to finish.

The use of a debit/credit card allows you to instantly purchase many types of tokens. Bitcoin, Binance Coin, Ethereum are large-cap digital currencies, whereas Basic Attention Token and Kava token are smaller ones. With a debit/credit card, you can buy a number of Defi coins, including Maker and yearn.finance. Once you have funded your account, you can manually buy the digital tokens you desire.

Inflation-to-crypto exchange rates:

The Instant Buy feature on Binance allows you to buy any digital currency, regardless of whether it is supported by your favourite currency or not. It has many markets for fiat-to-crypto conversions. In other words, you are buying a digital item that is valued in real money rather than in virtual currency.

Due to several Binance markets being priced in GBP, you do not have to worry about changing exchange rates. Whether you’re looking for Dogecoin, Ethereum, Bitcoin, or Litecoin, there’s something for everyone. You can also trade cryptocurrencies against currencies like the Australian dollar and Turkish lira on Binance

Tools and Features of Binance:

The features and functions of Binance are discussed below.

Analysis of Charts & Technical Data:

If you’re an experienced cryptocurrency trader, access to Binance’s advanced charts and indicators will certainly satisfy your requirements. If you visit the “Advanced” trading platform, you will find many charts analysis tools. By adjusting the trading interface, for example, you can align it with your specific preferences.

You can view graphing data with Trading View integration. Your pricing timeframe can be adjusted between 1 minute and a month. The platform also provides high-level order books, enabling you to monitor the markets from a bird’s eye perspective. Several charting tools and technical indicators are available on Binance, including the MACD and RSI.

There is a wide variety of order placement options available on Binance. In addition to standard buy/sell and market/limit orders, you can also place stop-loss and take-profit orders, and one cancels the other. Then again, Binance might seem intimidating if you are new to cryptocurrency. Traders with experience will find it ideal, but those who are just starting out may want to look elsewhere. You should give eToro a look if you want a user-friendly cryptocurrency platform.

Binance Earn

You could also earn from your cryptocurrency assets that are stored on Binance. They allow certain coins or tokens to be put into savings accounts to earn interest.

Crypto Savings Accounts:

In the past, cryptocurrency investments were only possible through capital gains. You can only make money when you sell your digital tokens at a higher price than what you paid. The result is that Binance has started offering interest-bearing savings accounts.

By depositing funds into a Binance savings account, you can earn interest on your crypto assets. The rate depends on the cryptocurrency and the exchange. A flexible or locked account is up to you. A flexible account allows you to withdraw money whenever you want.

In most cases, you could get started with a savings account for less than 10 USDT and there are no savings account withdrawal fees when redeeming your assets back to your Binance spot wallet.

Below we will explain how Binance flexible savings and locked savings work.

Binance Flexible Savings Account

You can easily transfer your coin/token into a flexible saving account by simply clicking the transfer button next to your digital asset on your Binance spot wallet. You would then start to receive an interest payment on a daily basis. You can also select the amount you want to put in a crypto flexible savings account so you don’t have to go all-in on the coin amount you hold. You can transfer money back from your savings account to your spot account at any time, immediately.

There are some minimum deposit investment levels. That could be 1, 0.1, or 0.01. It just depends on the coin but when you subscribe to the flexible savings account, from your computer desktop or the Binance App, it will inform you of the minimum amount.

The interest rates are different per coin, with stable coins earning the most interest at around 6% APY. Not every coin or token will allow flexible savings but Binance regularly adds new coins.

Locked Savings Account

If you know that you won’t withdraw your money from the savings account for a fixed period then you can apply for a Fixed Savings account. The time that the coins can be locked are normally 7 days, 14 days, 30 days, and 90 days. Some of these periods may not be available depending on the coin you have. Each locked time frame will normally pay different amounts of interest.

The amount you put into a locked savings plan is by lot sizes so you can’t just enter a random figure. The minimal amount to deposit will depend on the coin. The interest you earn in a lock period will not be given to you until the end of that time. You can still redeem early and transfer money back to your spot account at any time, but you will lose all the interest payment you received, should you choose to do so.

Locking your savings will allow you to earn more interest, so if you are not a regular trader and are planning to hold (HODL) for the long term, then this could be a better option than flexible savings.

Flexible and Locked Savings Account Risks

Like any other centralized exchange, that is not regulated, there is always some degree of risk.

There are risks that Binance could get hacked or go into liquidation. Another possible risk is if you use stable coins for your savings, like USDT, BUSD, USDC which are pegged to about 1 USA dollar, and it turns outs there is a question about their legitimacy. If the stable coins are not backed by an equal amount of USD they could face an audit risk and investigation.

There has been a proposed STABLE ACT which attempts to regulate USDT. If the act is approved and Tether cannot provide sufficient proof of their USD holding, USDT could become worthless.

Always do your own due diligence when investing in crypto coins or using exchanges. If you are willing to chance the risks, it has always been said, it is best to invest what you can afford to lose.

To access the official Binance website then visit here.

VISA card for Binance:

Binance’s Visa debit card can be used in real life to spend your digital tokens. For example, the card can be used to withdraw cash at an ATM, to purchase goods and services online, and to make purchases at physical stores. Among the many benefits of the Binance Visa card is that there are no fees. Plus, you’ll retain your capital gains since your bitcoin holdings will only be sold when the transaction takes place. With the Binance debit card, you can also earn cashback rewards.

Binance’s mobile application:

The company is the face of two smartphone apps developed by Binance. On top of the Binance website, there is the Binance app, which is available for Android and iOS smartphones. As the name implies, this is Binance’s main website, but in a mobile-friendly format.

Additionally, the app offers all of the same functions – such as trading cryptocurrencies, viewing your portfolio, transferring funds, and performing technical analysis – as well as those of the website. With Binance, you can perform two-factor verification; use your fingerprint, and whitelist devices. Trust Wallet was also created by Binance.

You can use this wallet on your phone to keep your bitcoins and other digital assets. Your wallet can be linked to decentralized exchanges like Pancake Swap if you wish to deposit funds through a debit/credit card. The Trust Wallet, on the other hand, is only compatible with Android devices and is no longer available for iOS devices.

Design and User Experience (UX):

It is very difficult to present exchanges as uncluttered and basic due to their nature. In order to give its users so many tools and information, Binance has one of the cleanest and easy-to-use user interfaces. In addition to the dark mode, which spares our eyes from the blindingly bright backgrounds of some rivals, the top menu bar offers a plethora of options, but they’re organized into sensible sections.

You can easily find what you’re looking for, and if you’re just starting out with the game, you’ll probably stick to the Trade, Wallet, and Account sections-all of which are easily accessible. On the website, there is a responsive layout with minimal wasted space, and the app follows this same polished design. The world’s number one exchanged information in one of the smoothest transactions I’ve seen.

How to begin on Binance:

Getting registered for Binance is fairly straightforward. You simply click on ‘Register Now’ on the Binance website homepage. You can receive a verification code by entering your e-mail or mobile number, then choosing a password. You can try checking your spam folder if you are having trouble receiving the confirmation email. Afterward, your identity will need to be validated to ensure that you are the owner of that account.

Despite the fact that it is a fairly standard procedure, this step always seems strange to newcomers to the crypto industry, but all respectable exchanges require it regardless. By collecting KYC (Know Your Customer) information from someone, you are making sure they are who they claim to be. A photo and an official identification card or document are required for verification. Selecting ‘Identification’ is done by clicking on the circular account icon.

By clicking the yellow “Verify” button, you’ll be required to input your name, address, and birthdate. After that, you will be asked to verify your ID with your preferred method, before providing a clear profile photo. Trading can then begin. For those who want a higher daily transaction limit, you can also provide additional documents to verify your address. Unless you plan on completing tens of thousands of crypto transactions per day, it isn’t a concern.

What is Binance and how does it work?

Binance offers a simple interface for buying, selling, and trading digital currencies such as Bitcoin and Ethereum. In this overview, we will give you an overview of the essential steps you need to take.

How to Sign up for a new account:

Go to Binance’s homepage where you can register an account. When using cryptocurrency only for depositing and withdrawing funds, you’ll need only an email address.

Assigning a second factor of authentication:

To protect your account, Binance will prompt you to set up two-factor authentication (2FA). You will need to install an application such as Google Authenticator on your phone. In the future, you will be required to enter a unique code each time you log in or perform important account operations like withdrawals.

How to Deposit coins:

We’ll assume that you’re looking to deposit funds with a cryptocurrency, even though some countries can now use credit cards and bank accounts. To make a fiat currency deposit, log into your account and go to the “Funds” section (if available).

Anyhow, on the Binance deposit page, you will need to scroll through and select the coin that you wish to deposit. If you have earned money on another site (such as Coinbase) you can transfer funds from your private wallet by using the wallet address given to you. It is also possible to send funds to this address from another site.

The minimum crypto/fiat deposit on Binance varies depending on the currency and payment method.

Binance Minimum Deposit For Crypto

There is virtually no minimum crypto deposit on Binance. For example, for Bitcoin, the minimum deposit is 0.00000001 BTC.

For other cryptocurrencies such as Ethereum and USDT, the minimum deposit limits, 0.00000001 ETH and 0.00000001 USDT are also no different than Bitcoin.

So you can basically deposit any amount of cryptocurrencies into Binance. But, if you want to trade, there are a few things you should keep in mind.

First, there is virtually no deposit limit, but there are minimum trade amounts on Binance.

So, if you want to trade cryptocurrencies on Binance, you should take into consideration the minimum trade amounts before depositing cryptocurrencies.

For USDT pairs like BTC/USDT, the minimum order size is 10 USDT. If you have less than 10 USDT worth of Bitcoin, you can’t sell it for USDT.

So, while the minimum deposit for Bitcoin is 0.00000001 BTC, you should deposit at least 20-30 USD worth of Bitcoin to trade on Binance without any issues.

You can check out all of Binance’s minimum trade amounts and other details on the trading rules page.

The second thing you should consider before depositing cryptocurrencies into Binance is withdrawal limits.

For Bitcoin, the minimum withdrawal limit is 0.001 BTC. If you’ve deposited and have less than 0.001 BTC in your wallet, you can’t withdraw it from Binance.

For USDT, the minimum withdrawal limits are 10 or 30 USDT depending on the network used for withdrawing USDT such as Ethereum and Tron.

The withdrawal limits on Binance vary according to the blockchain network that is chosen when withdrawing cryptocurrencies.

Withdrawals via Binance Chain (BEP2) and Binance Smart Chain (BEP20) offer much lower minimum withdrawal amounts.

But you should only use them if you want to transfer your cryptocurrencies to Binance Chain or BSC and they are supported by the receiving exchange.

Otherwise, your cryptocurrencies may end up in the wrong network and you may need to recover coins sent to the wrong address.

You can check out the minimum withdrawal limits on Binance on this page and make cryptocurrency deposits into Binance accordingly.

There is no fee for crypto deposits.

Minimum Fiat Deposit

The minimum Euro deposit via the bank card (Visa/MC) on Binance is 15 Euro.

To deposit Euro into Binance and see the minimum and maximum deposit amounts, you can visit the fiat deposit page on Binance.

The minimum USD deposit via the Bank Transfer (SWIFT) method on Binance is 50 USD.

Binance does not charge any fees when you deposit USD via SWIFT, but you should consider bank fees that vary according to your bank.

To deposit USD into Binance and see the limit, you can visit the fiat deposit page on Binance.

The minimum amount per transaction when buying cryptocurrencies with a credit/debit card on Binance is 15 USD or 15 euros.

The minimum amount for the credit/debit card payments varies depending on the fiat currency you select, which you can check out on the platform.

How to Trade on the Exchange:

Your bitcoin deposit will be approved within ten to twenty minutes, after which you may begin trading. Choose between the “Basic” or “Advanced” trading platform by hovering your mouse over “Exchange.” If you are just getting started in the business, you should select the former. Right now, you are able to trade over 540 different pairs of currencies. When purchasing coins that are not directly correlated to the cryptocurrency you deposited, you will need to make a second trade.

To acquire a smaller cap ERC-20 token unrelated to Bitcoin Cash, it may be necessary to trade your Bitcoin Cash first. You will now have your newly purchased currency in your Binance account once your transaction is complete. The money can either remain in your Binance account or be withdrawn to a different wallet. The Binance platform offers an API that you can use to connect your account to a variety of Crypto Trading bots and have them execute trades for you, automating your strategy and potentially generating profit.

Does Binance Support Cryptocurrencies?

Binance supports many different cryptocurrencies and also offers greater access to smaller tokens with smaller market capitalizations than Bitcoin and Ethereum. Sometimes you may have to convert your fiat money to a stable coin to purchase the smaller coins and tokens.

For example, if you wanted to buy the Kava token on Binance, then you would first exchange your fiat money for USDT (Tether). Once you have USDT then you could buy the Kava token on the exchange.

Is there a fee for trading on Binance?

While Binance makes money on maker/taker fees, every transaction will still cost you 0.1 percent. There will be a fee for each sale or purchase of a coin. The fee drops to 0.09 percent if you trade 500 bitcoins (or cryptocurrency equivalents) in a 30-day period.

In order to qualify for the lowest cost of 0.04 percent, however, you need to trade at least 150,000 BTC per month. As for market makers, they receive a starting fee of 0.1 percent as well. With a monthly volume of 150,000 BTC or more, you pay only 0.02%. Binance has one of the lowest trading costs in the cryptocurrency market. Even further minimization can be achieved by using the Binance Coin.

Does Binance have any trading restrictions?

Users from all over the world have previously been admitted to Binance, a worldwide cryptocurrency exchange.

The platform stopped accepting users from the United States in 2019. This was due to regulatory standards in the US. USA residents who wish to use Binance can now use the US version of the site that has a lower amount of cryptocurrencies to trade. Some states may be restricted from using it.

Making Deposits, Withdrawals, and Payments:

Withdrawals and deposits in fiat are now available on Binance’s cryptocurrency-only exchange. As of this writing, they accept credit cards and bank transfers as methods of payment.

Credit card:

Binance now allows you to purchase tokens using a credit card directly from its website. Besides Visa and MasterCard, it also accepts American Express. If the native currency is something other than USD or EUR, there may be an additional fee if using a credit card. There is a regular processing fee of 3.5 percent (minimum 10 dollars). In comparison to Coinbase, which charges 3.99 percent?

Bank account transfers:

Binance Jersey, the platform’s subsidiary, allows you to deposit and withdraw funds via bank transfer. You can transfer money to your Binance account by bank transfer from the United Kingdom, Europe, the United Arab Emirates, Singapore, Australia, and New Zealand as well as a number of other countries at this time. You will be provided with the account and reference numbers necessary to complete the transfer. Binance sometimes may temporarily suspend bank transfers for a particular country due to regulations.

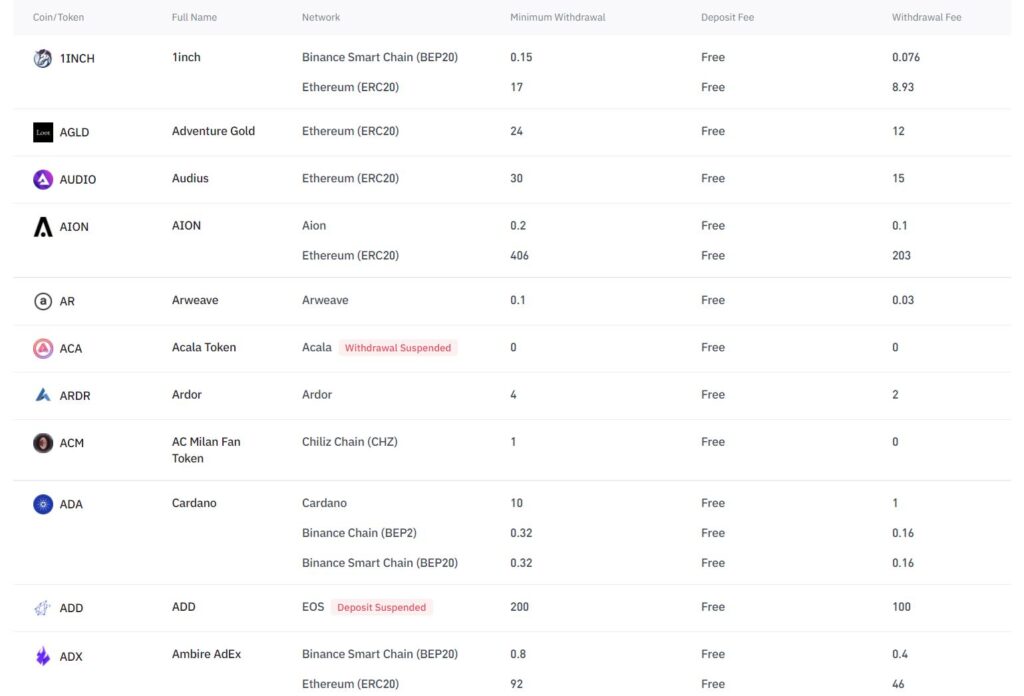

Binance Withdrawal Fees For Cryptocurrency

Users are required to pay a flat fee each time they withdraw cryptocurrency from their Binance account to cover the transaction costs.

The blockchain network governs withdrawal rates, and network congestion can cause them to fluctuate without notice.

For a full list of up-to-date withdrawal fees on Binance for coins and tokens then you can check out this page link.

Withdrawal Fees For Fiat

The price for withdrawing fiat from Binance varies depending on the currency.

For example, you can withdraw USD to your bank account using the Bank Transfer (SWIFT) method. The fee for withdrawing USD from Binance is 15 USD.

See this link for a current list of Fiat withdrawal fees.

Security at Binance:

Binance takes a variety of security measures to ensure that your funds are protected from external threats. The first thing that we recommend – and as we mention throughout the account setup guide – is to set up two-factor authentication (2FA).

The mobile device is the only way for someone to access your Binance account. You will also need to confirm your login with your registered email account if you attempt to login with an IP address you have not previously used. Additionally, you may receive email notifications about account operations like withdrawals.

For more security, you can also move your purchased crypto to an offline cold storage wallet like the Ledger Nano.

Regulations:

Malta recently passed the Virtual Financial Assets Act (VFA Act), which regulates the industry. Besides the Securities and Exchange Commission, Binance is licensed by no other regulatory authority. However, that doesn’t mean that the platform is not adhering to its anti-money laundering responsibilities.

Binance, on the other hand, requires consumers who wish to deposit and withdraw fiat money to go through a KYC process. When you withdraw over 2 bitcoins in 24 hours, a verification process will be necessary.

Customer service team:

Binance was flooded with new account applications in late 2017 when the crypto-craze was in full swing. Since then, Binance has substantially expanded its customer support team.

Through the Binance account page, you can send a ticket request for any questions or concerns you may have. You can also communicate with Binance Jersey’s support team 24 hours a day via live chat. It is not possible to reach Binance’s support staff via telephone. Social media, however, is a significant part of the platform. For example, Telegram and Twitter might be worth a try, if you have not received a response.

Conclusion:

The reason Binance is one of the largest cryptocurrency exchanges in the world is because of the things mentioned above. It is a great place to start when it comes to low trading costs, with hundreds of crypto-to-crypto trading pairs, the ability to earn from your crypto digital assets, and has improved security. I find it amazing how quickly the platform has progressed since it was launched in 2017. Although it has only existed for a few years, Binance is already responsible for trading volumes in the billions of dollars.

You can learn more about a Binance account here.

Disclaimer: The information provided on this page does not constitute investment advice, financial advice, trading advice, or any other sort of advice and it should not be treated as such. This content is the opinion of a third party and this site does not recommend that any specific cryptocurrency should be bought, sold, or held, or that any crypto investment should be made. The Crypto market is high-risk, with high-risk and unproven projects. Readers should do their own research and consult a professional financial advisor before making any investment decisions.

Some content via these sources: